Author: Content Moderator

-

Nestlé to Increase US Chocolate Prices Due to Rising Cocoa Expenses

Increasing commodity expenses affect chocolate pricingEnthusiasts of chocolate may soon notice a slight dent in their finances as Nestlé USA announces a price increase on select chocolate offerings, prompted by a significant rise in global commodity costs. The renowned confectionery company cites escalating prices of essential ingredients like cocoa and sugar, which have both faced…

-

“First Watch Tackles Increasing Commodity Expenses as Customer Visits Recover”

Increasing expenses for key breakfast componentsAt the beginning of 2024, the prices of essential breakfast products—especially eggs and avocados—have risen sharply, influenced by ongoing inflationary pressures throughout the agricultural supply chain. For commodity traders and finance experts in Australia, this development indicates sustained fluctuations in the fresh produce markets, affecting both local pricing and import…

-

“Gold’s Surge Exceeds General Commodity ETFs”

The effect of gold on commodity fund resultsWhen navigating the commodity market, my friend, gold plays the role of a heavyweight champion that can either elevate your portfolio or completely devastate it. Commodity funds, particularly those with a substantial portion of their assets tied up in gold, face substantial fluctuations in performance depending on the…

-

“Red Cloud Securities Names Ken Hoffman as Commodity Strategist”

Ken Hoffman joins Red Cloud SecuritiesRed Cloud Securities Inc. has revealed the hiring of Ken Hoffman as its new Commodity Strategist, effective immediately. Located in Toronto, the firm regards this key appointment as a significant enhancement to its research capabilities, with the goal of providing more profound insights and sharper analysis to clients navigating the…

-

“Oil Prices Jump 3% Due to Increased Buying Interest Despite Concerns of Oversupply”

Oil prices bounce back after initial declineOn Tuesday, crude prices experienced a significant rebound, with Brent crude futures increasing by $1.61 to close at $78.41 per barrel, while U.S. West Texas Intermediate (WTI) crude rose by $1.62, finishing at $74.07. This recovery followed a sharp decrease in prices prompted by OPEC+’s announcement over the weekend…

-

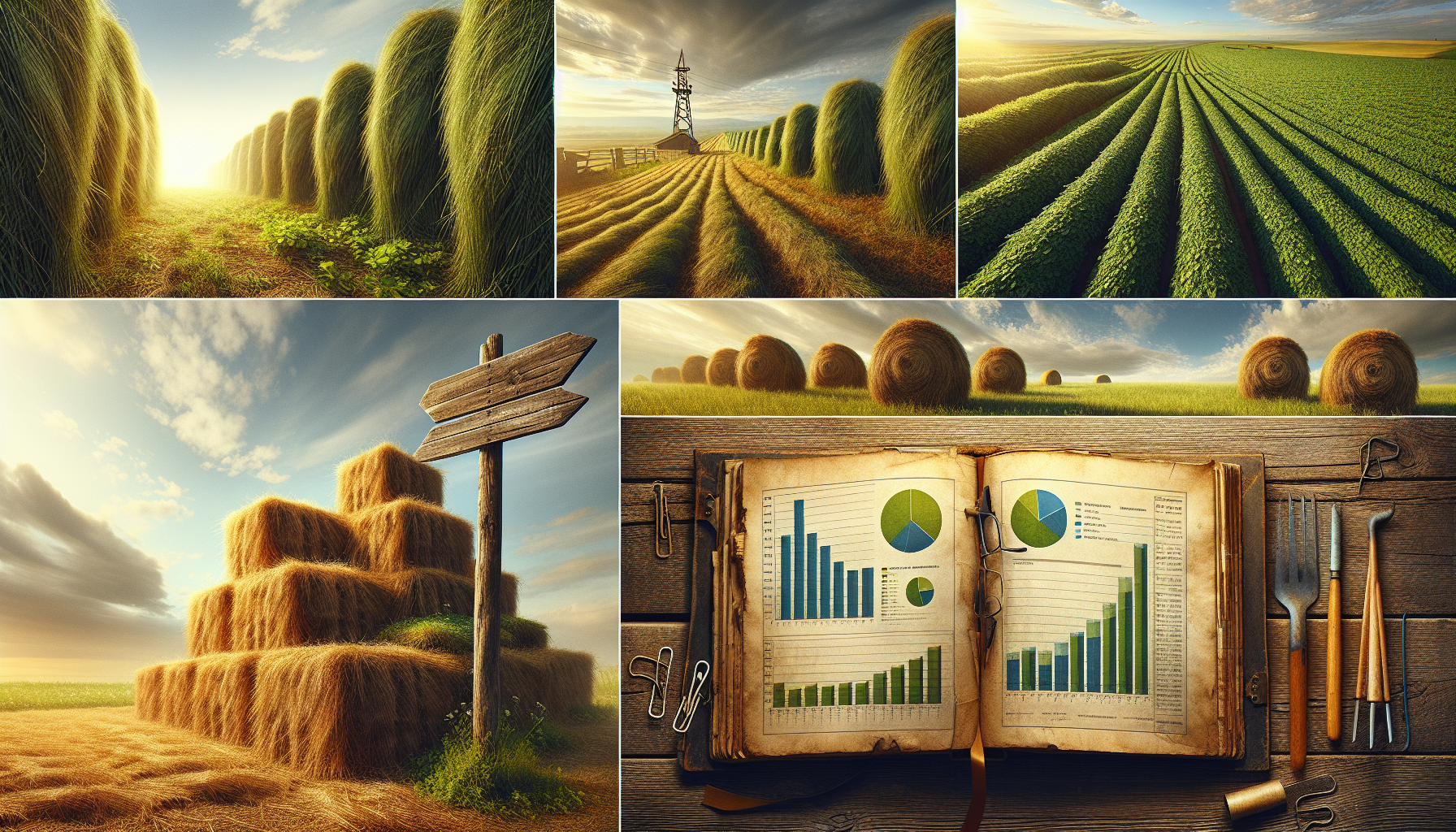

“Trends in the Hay and Alfalfa Market: Latest Insights”

Initial patterns in the alfalfa marketThe alfalfa market has begun to evolve as the season unfolds, with initial signs indicating a stronger pricing framework. Nick Foglio from Foglio Commodities mentions a visible increase in demand from both domestic and international buyers, especially those eager to secure premium products early in the season. This surge is…

-

Bybit Expands into U.S. Stocks and Commodities to Draw Institutional Investors

Entering traditional marketsBybit, primarily recognized for its cryptocurrency derivatives platform, has boldly ventured into conventional financial markets by launching trading options for US equities, commodities, and indices. This strategic move illustrates the exchange’s goal to establish itself as a more comprehensive financial services provider instead of remaining solely focused on cryptocurrency. This initiative allows traders…

-

“Insights and Trends on Commodity Prices in Bengaluru”

Overview of commodity pricesCommodity markets in Bengaluru on May 3 exhibited a variety of trends across key agricultural products, showcasing both seasonal supply factors and overall market mood. Traders noted moderate activity levels, with price changes influenced by procurement schedules, local demand, and arrivals from other states. Wheat prices remained consistent, bolstered by steady demand…

-

“BMI Reduces 2025 Henry Hub Projection, Maintains Brent Oil Aim at $68/bbl”

Natural gas price surge influenced by supply and demand factorsNatural gas prices have recently experienced a significant upswing, propelled by a combination of tightening supply conditions and a revival in demand within key markets. Latest figures indicate a marked recovery in prices, primarily driven by heightened stockpiling efforts and overarching trends in energy consumption, especially…

-

WisdomTree Unveils Revolutionary Commodity Carry ETC

Grasping carry in commodity investingIn the realm of commodity investing, the notion of “carry” is vital in influencing returns. Instead of depending solely on the appreciation of the commodity’s price, investors frequently obtain returns via carry, which encapsulates the costs or advantages of maintaining a commodity position throughout time. Several factors impact carry, such as…